Facing financial difficulties can be daunting, and the thought of filing for bankruptcy may feel like the end of the world. However, depending on your circumstances, bankruptcy may actually be right for you. This article, while not legal advice, will help you understand what bankruptcy is, what you should consider before filing for it, and how it will affect you afterwards.

What is Bankruptcy?

The Court may declare someone to be bankrupt if they owe debts of at least S$15,000 that are immediately due, which they cannot repay.

A Bankruptcy Order may be filed by either the debtor themselves or the creditors.

Role of OA and PTIB in Bankruptcy

The Official Assignee (OA) is a public servant under the Ministry of Law. The OA administers cases where an order was made prior to November 2023 and regulates other insolvency practitioners.

Since November 2023, the law has changed such that most bankruptcy cases will be administered by a Private Trustee in Bankruptcy (PTIB). The PTIB must be a licensed insolvency practitioner, nominated by whoever is applying for the bankruptcy. The PTIB manages the bankrupt’s estate, collects necessary documents, communicates with creditors, liquidates assets to repay creditors, and agrees with the bankrupt person on a monthly contribution to be repaid to the estate.

The PTIB will also facilitate obtaining approval for the bankrupt to travel, commence court action, or act as a manager/director of a business. The PTIB’s administration of a bankruptcy case will also be subject to an annual review by the OA.

While the certificate of discharge or annulment from bankruptcy is issued by the OA, your PTIB will play a crucial role in preparing reports for the OA to assess the situation and determine whether the conditions have been met by the debtor.

The OA’s deposit will cover regulatory oversight of insolvency practitioners, maintenance of case files and records with the Ministry of Law, and management of funds contributed to the bankrupt’s estate.

Misconceptions about Bankruptcy

A common misconception about bankruptcy is that once you are a bankrupt, you will always be recognised as one. However, that is not true—bankrupts may have their bankruptcy annulled or discharged by the High Court or Official Assignee (OA).

An annulment order would place the debtor in the same position as if no bankruptcy order had been made against them. However, if the debtor incurred debts during bankruptcy, those may still need to be repaid, and creditors can take legal action to recover them.

Similarly, bankrupts may be discharged with an order either from the High Court or the OA. The minimum timeline for a discharge is 3 years, and most bankrupts will be discharged within 5 to 7 years. However, the debtor’s name will remain on the bankruptcy register for 5 years after the date of discharge if the debtor has paid off their total contribution. If the debtor has yet to pay their total contribution, their name will remain on the register.

Frequently Asked Questions

Why Voluntarily File for Bankruptcy?

Individuals facing financial difficulties may wish to consider voluntarily filing for bankruptcy as:

- Bankruptcy stops your debts from piling up even further by stopping interest charges on the principal sum owed.

- The trustee will determine a suitable monthly contribution that considers your monthly income and necessary expenditure, and not the total debt that you owe.

- Bankruptcy protects you from further legal action from your creditors to recover debts incurred before your bankruptcy.

When to Consider Filing for Bankruptcy?

You can consider filing for bankruptcy if your debt is above $15,000 and is due immediately, but you are unable to pay it. Additionally, if you are unable to come to an agreement with your creditors on repaying the debt, bankruptcy may be a suitable solution.

Costs of Filing for Bankruptcy

To file for bankruptcy, you will incur these administrative costs:

- A bankruptcy deposit of S$1,850 must be paid to the OA

- Filing a bankruptcy application: S$60

- Filing an affidavit: S$1 per page, including any exhibitsFiling a

- Statement of Affairs: S$5

This is exclusive of any fees you may incur from engaging a bankruptcy lawyer, or any deposit which may be required by your Private Trustee in Bankruptcy.

What happens after Declaring Bankruptcy?

Should you be declared a bankrupt by the Court, you will be required to attend a briefing at the OA’s office on your responsibilities as a bankrupt and to submit your Statement of Affairs, which is a declaration of your assets and liabilities, within 21 days from the date of the making of your Bankruptcy Order.

Subsequently, you will have to agree on the monthly contribution to be paid to your bankruptcy estate, which will be distributed as dividends to your creditors upon your discharge from bankruptcy.

All your non-protected assets will be vested in the OA, including savings accounts, private properties, insurance policies and private vehicles, which will subsequently be sold for proceeds to be distributed to creditors.

All your existing bank accounts will be closed, except for one savings account with approval from the OA. Your particulars will also be published in the newspaper to inform the public of your bankruptcy status.

Responsibilities as a Bankrupt

Once you have been declared bankrupt, you will have the following responsibilities:

- Make a full and frank disclosure of all your assets to the OA, including property that you disposed of before the bankruptcy.

- Submit regular statements of your moneys and property.

- Make monthly contributions to your bankruptcy estate for the benefit of your creditors.

- Contribute any excess monies to the bankruptcy estate.

- Keep the OA updated on your place of residence and contact details.

- Attend any meetings with the OA.

Limitations of a Bankrupt

As a bankrupt, there are also several limitations:

Travel Limitations

- You will only be allowed to leave Singapore or remain overseas with the approval of the OA. Apply at least 14 days before departure, stating the reason, destination, and period of travel.

- If you need to travel frequently, you may apply for block periods of travel, subject to your conduct in bankruptcy.

Court Action

- You cannot commence or continue any court action (except for damages or compensation for personal injuries or wrongful acts against you) without the consent of the OA.

Gaming & Gambling

- You cannot enter the casinos in Singapore or gaming machine rooms operated by private clubs in Singapore.

- You cannot access remote gambling services, including Singapore Pools account-related services.

Obtaining Credit & Loans

- You must disclose your bankruptcy status to a lender if obtaining credit or a loan exceeding S$1,000.

Managing a Business or Becoming a Director

- You need the OA’s or PTIB’s permission to manage or take part in any business or act as a director for any corporation.

Alternatives to Bankruptcy: Debt Repayment Scheme (DRS)

The Debt Repayment Scheme (DRS) is an alternative repayment scheme administered by the OA.

To be considered for the DRS, debtors must:

- Not owe a sum exceeding S$150,000.

- Be employed with a regular salary, which must be declared to the Court during a bankruptcy application.

- Not be bankrupt or placed on the DRS in the past 5 years.

- Not be a sole proprietor or partner in any organisation.

- Not have been subject to a court-based arrangement with creditors in the past 5 years.

An application for the DRS can only be initiated via a bankruptcy application. If the total sum due and owing is less than S$150,000, the Court will adjourn the matter for consideration by the OA.

If the OA deems the debtor suitable for the DRS, they will administer it instead of declaring the debtor bankrupt. An administrator will devise a repayment plan requiring regular debt repayments to the creditors over a fixed period, which will not exceed 5 years.

The DRS seeks to achieve a win-win outcome for both debtors and creditors:

- Debtors can avoid bankruptcy and its restrictions and social stigma by entering a Debt Repayment Plan under the scheme.

- Creditors are assured that their interests are adequately safeguarded.

Find out more about the Debt Repayment Scheme.

How to Declare Bankruptcy in Singapore

Requirements for Self-Filing

A person applying to the Court for bankruptcy, whether by a creditor or debtor, must nominate a licensed insolvency practitioner to administer the bankruptcy case. The bankruptcy application must be accompanied by the written consent of the licensed insolvency practitioner.

The Court will not make a bankruptcy order if neither a licensed insolvency practitioner nor the OA has consented to act as the trustee in bankruptcy.

Process to File for Bankruptcy

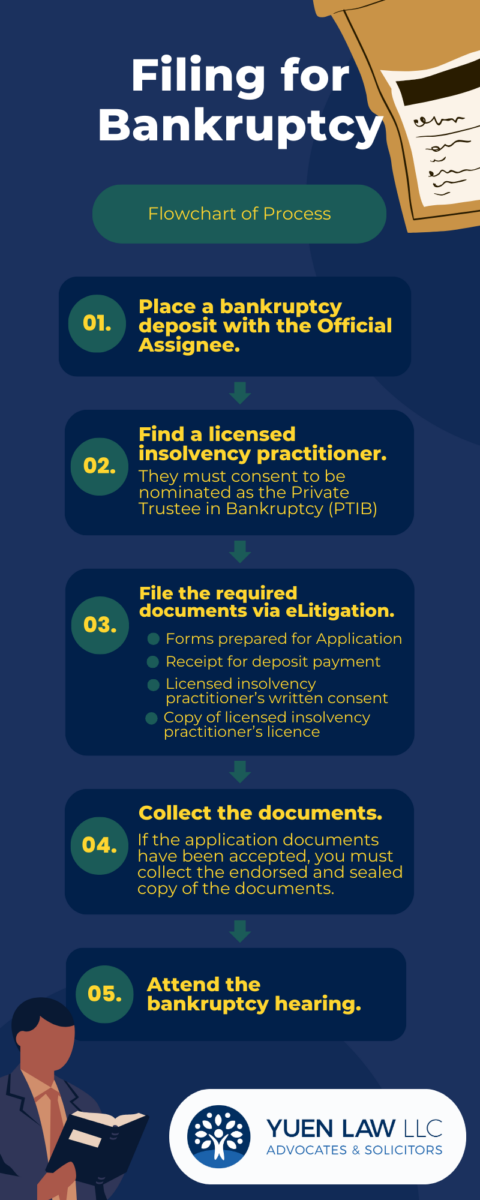

We have prepared a simple flowchart:

- Place a bankruptcy deposit of S$1,850 with the Official Assignee.

- Find a licensed insolvency practitioner to consent to be nominated as the Private Trustee in Bankruptcy (PTIB).

- File the required documents via eLitigation, including:

- Forms prepared for the application

- Receipt for deposit payment

- Written consent from the licensed insolvency practitioner

- Copy of the licensed insolvency practitioner’s licence

- Collect the endorsed and sealed copy of the documents if the application documents are accepted.

- Attend the bankruptcy hearing.

Why Engage a Bankruptcy Lawyer as your PTIB?

A bankruptcy lawyer can help you assess whether filing for bankruptcy might be your best course of action. They can assist with the complex procedures and forms required for bankruptcy filing. Additionally, a bankruptcy lawyer can act as an intermediary between you and your creditors, especially when you have multiple unrelated creditors owed varying amounts and types of debt.

Benefits of Engaging a Legal Practitioner as your PTIB

As of 1 November 2023, debtors and creditors must appoint a PTIB to administer bankruptcy cases, except in cases of public interest where the OA may assume this role. PTIBs in Singapore are solicitors or public/chartered accountants holding an insolvency practitioner license.

Engaging a solicitor as your PTIB ensures you are equipped to handle legal issues, particularly those involving asset recoveries, complex bankruptcies, or clawbacks.